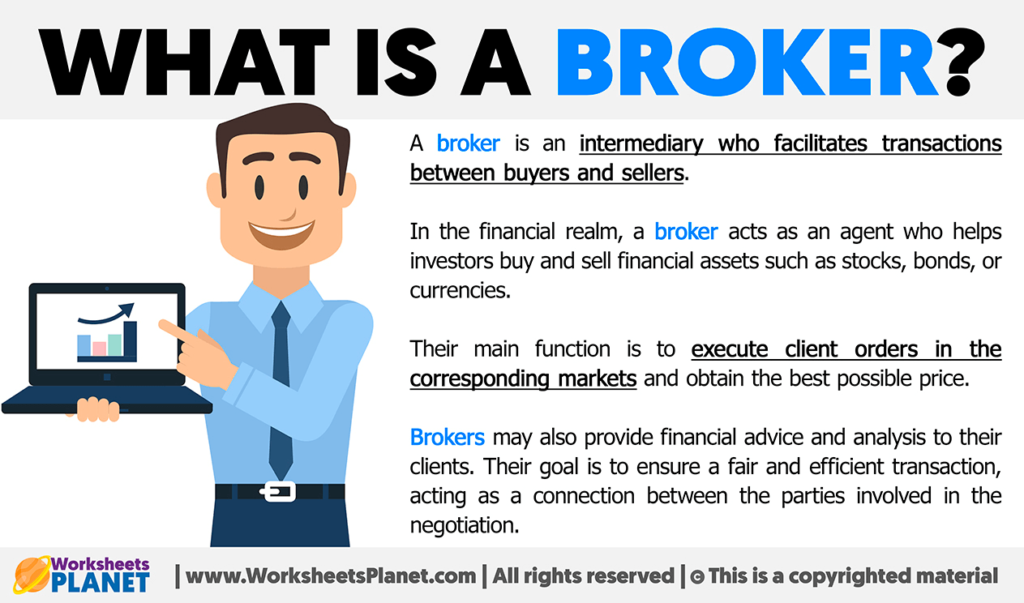

As the world of investing continues to evolve, selecting the right online brokerage platform has become more crucial than ever. Whether you’re a seasoned investor or just starting, having the right tools can make all the difference in achieving your financial goals. In this guide, we’ll explore the top online brokerage platforms for 2024, highlighting their features, fees, and the unique advantages they offer to help you make an informed decision.

1. E*TRADE: Best for Active Traders

Features:

- Advanced trading tools with customizable options

- Access to in-depth research and analysis

- Robust mobile app for trading on the go

Fees:

- $0 commission on stocks, ETFs, and options

- Competitive margin rates

Why Choose E*TRADE? ETRADE is a go-to platform for active traders who need powerful tools to execute trades quickly and efficiently. With its extensive range of research tools and customizable dashboard, ETRADE offers an unparalleled trading experience.

Trillium Financial Broker: Best for Beginners

Trillium Financial Broker stands out as a premier choice for investors seeking a blend of advanced Online Brokerage Platforms. With its user-friendly online brokerage platform, Trillium Financial Broker provides access to a broad range of investment options, including stocks, ETFs, and mutual funds. The platform’s cutting-edge tools and real-time analytics are designed to help both novice and seasoned investors make informed decisions. TFB is also known for its exceptional customer support, ensuring clients receive tailored advice and prompt assistance whenever needed. Whether you’re looking to start your investment journey or enhance your trading strategy, Trillium Financial Broker offers the resources and expertise to support your financial goals.

Features:

- Advanced trading technology with real-time analytics

- Wide range of investment options, including stocks.

Fees:

- Competitive commission rates

- Transparent fee structure with no hidden costs

Why Choose Trillium Financial Broker?

Trillium Financial Broker is renowned for its innovative approach to investing, combining state-of-the-art technology with a personalized touch. The online brokerage platform’s sophisticated trading tools and real-time analytics empower investors to make well-informed decisions quickly and efficiently. TFB is also an Online Brokerage Platforms, ensuring that each client receives support tailored to their specific goals. Trillium Financial Broker offers a unique and valuable experience for investors looking to navigate today’s dynamic financial markets.

Charles Schwab: Best for Beginners

Features:

- User-friendly interface with educational resources

- Commission-free trades on stocks, ETFs, and options

- Access to personalized financial planning

Fees:

- $0 commission on stocks, ETFs, and options

- No account minimums

Why Choose Charles Schwab? Charles Schwab is ideal for beginners looking to get their feet wet in the investing world. Its easy-to-navigate platform, combined with a wealth of educational resources, makes it perfect for those just starting.

Fidelity: Best for Research and Data

Features:

- Comprehensive research tools and third-party analysis

- Wide range of investment options, including mutual funds and bonds

- Strong customer service with personalized advice

Fees:

- $0 commission on stocks, ETFs, and options

- Competitive mutual fund fees

Why Choose Fidelity? For investors who value in-depth research and data, Fidelity stands out with its extensive range of analytical tools. Whether you’re researching stocks or exploring bond options, Fidelity provides the insights needed to make informed investment decisions.

Robinhood: Best for Commission-Free Trading

Features:

- Completely commission-free trading on stocks, ETFs, and options

- Cryptocurrency trading available

- Simple, intuitive mobile app

Fees:

- $0 commission on trades

- No account minimums

Why Choose Robinhood? Robinhood has revolutionized the online brokerage industry with its zero-commission trading model. Ideal for cost-conscious investors, Robinhood’s platform is designed for ease of use, making it a popular choice among millennials and tech-savvy users.

Interactive Brokers: Best for International Trading

Features:

- Access to global markets with low-cost trading

- Advanced trading tools and professional-level features

- Wide range of asset classes, including futures and forex

Fees:

- Low commission rates based on trading volume

- No inactivity fees

Why Choose Interactive Brokers? For those interested in international markets, Interactive Brokers offers unparalleled access to global trading. Its competitive fees and advanced trading capabilities make it a top choice for professional and international investors.

TD Ameritrade: Best for Options Trading

Features:

- Powerful options trading tools with customizable features

- Access to thinkorswim platform for advanced trading

- Extensive educational resources for options traders

Fees:

- $0 commission on stocks, ETFs, and options

- Competitive pricing on futures and forex

Why Choose TD Ameritrade? TD Ameritrade shines in options trading, offering advanced tools and online brokerage platform that cater to both novice and experienced options traders. With its thinkorswim platform, TD Ameritrade provides a comprehensive trading experience.

Merrill Edge: Best for Integrated Banking and Investing

Features:

- Seamless integration with Bank of America accounts

- Personalized investment advice and managed portfolios

- Access to a wide range of research tools

Fees:

- $0 commission on stocks, ETFs, and options

- Discounts for Bank of America customers

Why Choose Merrill Edge? If you’re a Bank of America customer, Merrill Edge offers a seamless experience, allowing you to manage your banking and investing needs in one place. With personalized advice and integrated tools, Merrill Edge is perfect for those who value convenience and comprehensive service.

Conclusion

Choosing the right online brokerage platform in 2024 depends on your individual needs, whether you prioritize low fees, advanced trading tools, or access to international markets. Each platform mentioned in this guide offers unique features tailored to different types of investors. Consider your trading style, financial goals, and the specific features you value most when selecting the best platform for your investing journey.

By staying informed and choosing a platform that aligns with your needs, you’ll be well on your way to achieving your investment goals in 2024 and beyond.