The insurance industry has always been competitive, but in today’s digital age, the stakes are higher than ever. With customers demanding more personalized and efficient services, the role of technology has become crucial in maintaining a competitive edge. Modern insurance software is revolutionizing the way insurance companies operate, particularly in the realm of insurance lead generation. This blog will explore how modern insurance software is transforming lead generation and why it’s essential for insurers to embrace these advancements.

1. The Evolution of Insurance Lead Generation

1.1. Traditional Methods

In the past, insurance lead generation relied heavily on traditional methods such as cold calling, direct mail campaigns, and referrals. While these methods have their place, they are often time-consuming, labor-intensive, and yield inconsistent results. Additionally, these approaches tend to lack the precision needed to target specific demographics effectively.

1.2. The Shift to Digital

The advent of digital marketing and advanced data analytics has shifted the focus of lead generation towards more targeted and efficient strategies. Today, insurers can leverage online tools to gather insights about potential customers, segment audiences, and deliver personalized marketing messages. This shift has made lead generation more streamlined and effective, allowing insurance companies to connect with the right prospects at the right time.

2. How Modern Insurance Software Enhances Lead Generation

2.1. Data-Driven Insights

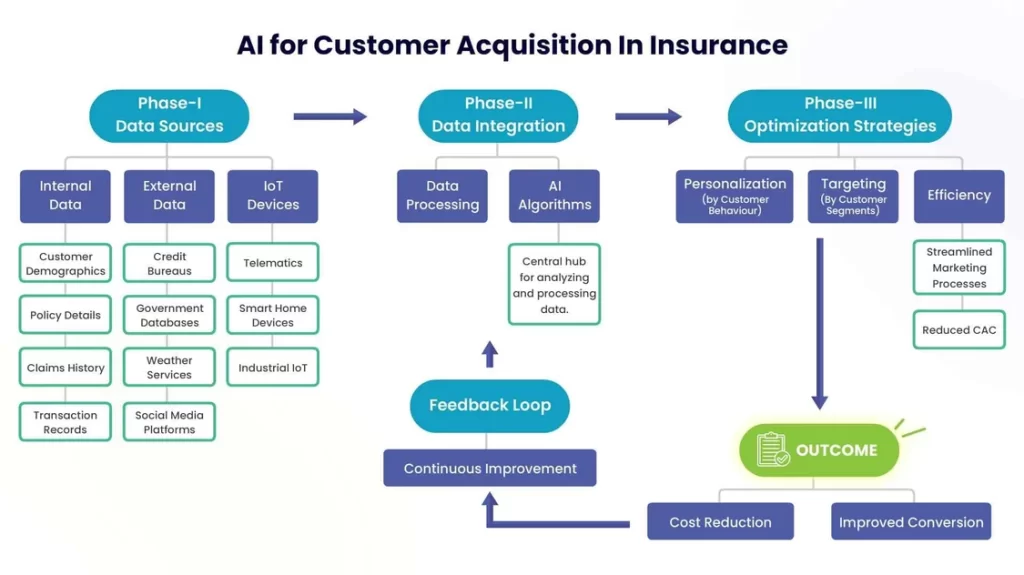

Modern insurance software provides insurers with access to vast amounts of data, which can be analyzed to uncover valuable insights about customer behavior, preferences, and needs. By utilizing data analytics, insurers can identify patterns and trends that help them tailor their lead generation strategies. For instance, software can analyze past customer interactions to determine which marketing messages resonate most with specific audiences, thereby increasing the chances of conversion.

2.2. Automation of Marketing Processes

Automation is one of the most significant benefits of modern insurance software. Through automation, insurers can streamline their marketing processes, reducing the need for manual intervention. Automated email campaigns, for example, can be set up to nurture leads over time, sending personalized messages based on where the prospect is in the sales funnel. This not only saves time but also ensures that leads are consistently engaged, improving the likelihood of conversion.

2.3. Enhanced Customer Relationship Management (CRM)

Modern insurance software often includes advanced CRM tools that help insurers manage their relationships with potential and existing clients more effectively. These tools allow insurers to track interactions, schedule follow-ups, and manage customer information in a centralized system. By having a comprehensive view of each customer’s journey, insurers can provide more personalized service, which is critical in building trust and converting leads into loyal clients.

2.4. Integration with Digital Marketing Channels

Another key advantage of modern insurance software is its ability to integrate seamlessly with various digital marketing channels. Whether it’s social media, search engine marketing, or content marketing, these software solutions enable insurers to launch and manage campaigns across multiple platforms from a single interface. This integration ensures that lead generation efforts are cohesive and that data from different channels can be aggregated and analyzed to refine strategies further.

3. The Importance of Investing in Modern Insurance Software

3.1. Staying Competitive

In a highly competitive market, insurers must stay ahead of the curve by adopting the latest technologies. Modern insurance software provides the tools necessary to enhance efficiency, improve customer satisfaction, and ultimately drive growth. Companies that fail to invest in these technologies risk falling behind competitors who are better equipped to meet the demands of today’s digital-savvy consumers.

3.2. Improving ROI

While the initial investment in modern insurance software may seem significant, the long-term benefits far outweigh the costs. By improving lead generation strategies and increasing conversion rates, insurers can achieve a higher return on investment (ROI). The efficiency gained through automation and data-driven decision-making also translates into lower operational costs, further boosting profitability.

3.3. Adapting to Changing Customer Expectations

Today’s customers expect personalized, timely, and relevant interactions with the companies they engage with. Modern insurance software enables insurers to meet these expectations by providing the tools needed to deliver tailored experiences at scale. By doing so, insurers can build stronger relationships with their customers, leading to increased loyalty and retention.

The integration of modern insurance software into lead generation processes is no longer just an option; it’s a necessity for staying competitive in the insurance industry. By leveraging data-driven insights, automating marketing efforts, enhancing CRM capabilities, and integrating with digital marketing channels, insurers can significantly improve their insurance lead generation strategies. Investing in these technologies not only helps in attracting and converting leads but also ensures long-term success in an increasingly digital marketplace. As customer expectations continue to evolve, the importance of modern insurance software will only grow, making it a critical component of any successful insurance business.

Integrating modern insurance software into lead generation is no longer optional; it’s essential for maintaining a competitive edge in the insurance industry. By harnessing data-driven insights, automating marketing efforts, enhancing CRM functionalities, and connecting with digital marketing channels, insurers can dramatically improve their lead generation strategies. Investing in these technologies not only aids in attracting and converting leads but also paves the way for sustained success in a rapidly evolving digital market. As customer expectations continue to rise, modern insurance software will increasingly become a vital element in the success of any insurance business.